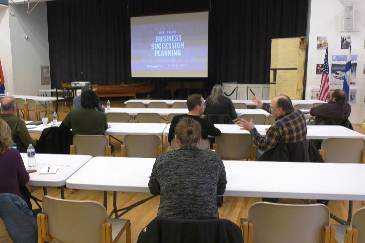

HANCOCK, Mich. (WZMQ) – Estate planning is recognized as an important step to ensure that your assets are passed on in the manner you choose. The same is true when it comes to small businesses. That’s why Range Bank, in conjunction with the law firm Kendricks Bordeau, held a business succession planning seminar focused on protecting your business and ensuring a smooth transition upon retirement.

“People know, eventually they want to retire, but they don’t really know how to go about it, and it’s a little different when you’re a small business owner to plan for that, as opposed to somebody who’s just, you know, 30 years in getting their pension,” said Attorney Laura Katers Reilly.

Attorneys and banking experts were on hand to answer questions about when to start planning the financial tools you may need and strategies for passing your business on to the next generation.

“How early you should start planning for the next step in your business, who you might talk to about developing those plans,” said Katers Reilly.

Handing the business down through the generations is an American tradition, but it’s important to make sure that the next generation is even interested.

“I’ve been in many meetings at this point in my career where the parents have said, Well, naturally, our kids want the business, and I have to stop them and say, Have you asked them? And sometimes they’re like, No, we really hadn’t thought to ask them,” said Katers Reilly.

And the process can be even more challenging when multiple siblings and family members are involved.

It’s very difficult for multiple family members to co-own a business.

“So if you have multiple children and you’re thinking, they’re all just going to happily co-own the business together, put the brakes on, talk to them about what they really want and do not want,” said Katers Reilly.

The bottom line is to have a plan in place. And as the adage goes, failure to plan is planning to fail.