LANSING, Mich. (WZMQ) – House Republicans are working to cut taxes for Michgian workers. The state House of Representatives passed a bill to cut state income taxes on Tuesday. The legislation would lower the rate from 4.25% to 4.05% percent.

As lawmakers work on the 2026 fiscal year budget, House Republicans have the cuts at the top of their list of priorities. The plan was introduced to reverse actions that increased income taxes just a year after the last decrease occurred. Representative Dave Prestin (R-Cedar River) said the original legislation was misinterpreted, and they are hoping to correct the mistake.

“Taxpayers shouldn’t be paying more into the system than what they need to. Everybody’s under pressure and you catch some relief wherever you can get it.” Prestin said. “That’s what we’re all about, is trying to do more with government, be more efficient with government, and really just lessen the burden upon Michigan taxpayers and do more with the money that we have.”

The 2015 law called for a decrease in the income tax if general fund revenue grew faster than inflation. That cut was triggered in 2023, Prestin said the intention was for that change to be permanent, but actions from Governor Whitmer and Attorney General Nessel reversed the change, and Michigan courts upheld their decision.

While 7 Democrats voted with Republicans supporting the bills, others said the change wouldn’t be noticeable to Michigan workers but would cut millions of dollars in revenue for the state.

Representative Jasper Martus (D-Flushing) said the cut is peanuts for the vast majority of the people that he represents. Martus said the real people who would benefit from this are the ultra-wealthy worth hundreds of millions of dollars and billionaires. He explained the bottom 20% of Michiganders would get about $11.00 a year, most middle-class families would get just $77 a year, leaving millionaires gaining a few thousand extra dollars a year from the cut. He believes the whole income tax system in Michigan needs to be redone.

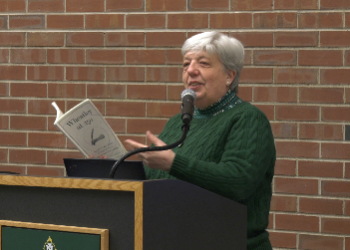

“I think that we need an amendment to our constitution that allows for there to be a progressive income tax. I think that we could build our tax system in a way that provides tax relief for 90 to 95% of Michiganders while making sure that the wealthy pay their fair share. I think it’s fiscally responsible, it would allow us to be a lot more nimble when we’re having these conversations about making sure the budget is balanced by making sure that we can ask the wealthy to pay more.” Martus said. “It’s also a question of fairness… we’re not looking to come after folks that are very, very successful. We’re not coming after the top 1%. We’re talking about the top 1/10 of 1% who are disproportionately benefiting from this system. It’s a question of economics as much as it is a question of fairness. While this debate in Lansing was occurring on lowering the income tax, this question of a constitutional amendment has to be handled by the people.”

House Republicans are holding their ground, claiming the state can do without the extra funding to save every penny for Michgian families.

The bill is now waiting in the Senate for consideration, Senate leaders have yet to comment on whether or not they’ll support the cuts.