LANSING, Mich. (WZMQ) – There is less than a month left of tax season, and the Michigan Treasury has some reminders, whether you’ve filed your return or not.

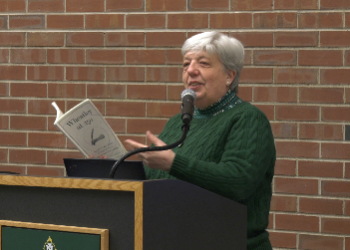

Whether you’re filing online, filling out paper forms, or going through a professional tax preparer there are a few things to keep in mind if you haven’t completed your taxes yet. Sarah Rusnell, the outreach manager with Michigan’s Treasury Department said they are highlighting two big tax savings to remember when you file.

The Earned Income Tax Credit is for people with low to moderate incomes and could add 30% of the federal credit to your state return.

The second saving opportunity is the retirement tax rollback, which is now in its second year and could mean an expanded subtraction if you’re retired or collect a pension or IRA.

To make sure you collect as much savings as possible, Rusnell recommended finding a tax professional to help with your return.

“Your best friend during tax season is a qualified tax professional who is right for you,” Rusnell said. “You want to make sure that you are interviewing and asking good questions of tax preparers that you might be working with to make sure that they’ve handled the situation like yours before.”

Free to low-cost tax help is available through the state and IRS at michiganfreetaxhelp.org and irs.treasury.gov/freetaxprep/.

The michigan treasury also has a free online tax estimator to help determine which tax situation is the best for you at michigan.gov/incometax.

Once you do file, Rusnell said E-filing and signing up for a direct deposit return is the best way to get your return quickly. If you’ve already submitted your tax forms, Rusnell said it can take 4 to 8 weeks to receive your return. After that, you can check the status of your return online at Michigan.gov/wheresmyrefund