WASHINGTON, D.C. – Should Members of Congress trade stocks? Right now, they are currently allowed to do that as long as they’re not trading based off insider information, but congress is once again floating the idea of banning stock trading for current members of congress amid concerns about protentional corruption.

“Let me be clear from the outset trading stock on insider information is a serious crime and must be prosecuted to the fullest extent of the law,” said Rep. Bryan Steil (R- WI).

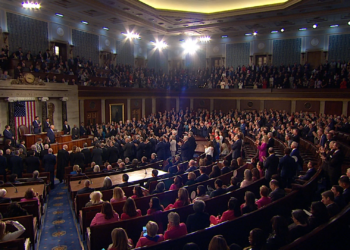

In a recent House congressional hearing, it focused on congressional members trading stocks.

“The oath we take as members swears fidelity to the constitution and the rule of law over personal gain or financial benefit,” said Rep. Joe Morelle (D- NY).

“In recent years, social media accounts have generated attention for aggregating the stock trades of members of congress,” said Rep. Steil. “Understandably it fuels a lot of public concern that lawmakers may be using their positions of authority to personally benefit themselves. While rules already govern how public officials trade stocks, stronger restrictions may be necessary to restore public trust and ensure officials are not profiting from their positions.”

About 13 years ago, congress passed the STOCK Act. It’s a law that prohibits members of Congress and other federal employees from using nonpublic information gained form their official duties for personal profit. It requires disclosure of any stock trades over a thousand dollars within a month. However, some claim the enforcement mechanism is lacking, and it includes a relatively small fine for failing to report transactions. Some members suggest the current system might need to be revamped.

“Some potential reforms include updating the STOCK Act reporting and enforcement requirements, requiring advanced disclosures and outright banning of individual ownership of individual stocks,” said Rep. Steil.

In a July report from the House Ethics Committee after a four year investigation, they reprimanded Representative Mike Kelly (R- PA) and urged him and his wife to sell their holdings in a steel company in his district. The 2021 complaint to the committee claimed the congressman’s wife bought stock in that steel company based on non-public information that Rep. Kelly learned from his official work. The report cleared the congressman of intentionally causing his wife to trade stock based on insider information and having a conflict of interest, determining there wasn’t evidence to prove those two wrongdoings. However, the report stated Kelly broke the House’s code of conduct “by failing to meet his duty of candor.”

That ethics report launched fresh talks in the summer within both chambers about concerns of corruption and eroding public trust with members of Congress and stock trading.

“Members of congress should not be able to buy stock, individual stock, while they’re members of this body,” said Senator Josh Hawley (R- MO) during a July 2025 hearing.